What is PCI DSS Compliance?

There is an increasing presence of cyber crime and online data theft, there are several influences for the increase but one of the main ones being the pandemic. In 2006 the major card brands (Visa, MasterCard, JCB, American Express and Discover) established the Payment Card Industry Security Standards Council; an independent global organisation with the aim to combat the threats and improve payment security.

The Payment Card Industry Data Security Standards (PCI DSS) were then developed as a list that merchants who process, transmit or store credit card information had to follow and adhere to. It presents common sense steps that mirror best security practices, maintaining these practices are vital to ensure the success of a merchant’s online business.

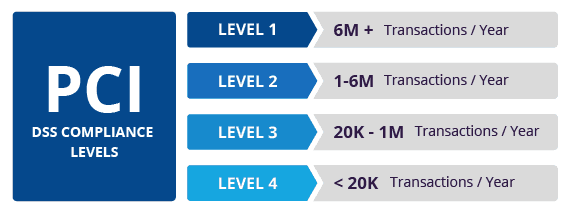

What are the PCI compliance levels?

Everyone who accepts credit cards, or even mobile payments, must be compliant with PCI DSS. The process of validating a company’s compliance varies widely, depending on the type and size of the business. For you to understand what minimum level you as a merchant require for your online shop please see the check list below. Merchants fall into one of four levels.

Why do you need PCI compliance?

Failure to comply with data security standards could be disastrous and have serious long-term negative consequences. Compromised data negatively affect consumers, merchants, and financial institutions. Just one incident can severely damage the reputation and ability of an organisation to conduct business effectively. Account data breaches can lead to catastrophic loss of sales, relationships and standing for a business in the market place, and depressed share price if the business is a public company, whilst negative consequences also include lawsuits, insurance claims, cancelled accounts, payment card issuer fines and many others.

How can Appletree Payment Services help me comply?

Appletree successfully achieved full audited compliance with the PCI DSS as a Level One Service Provider, demonstrating a clear commitment and effort to ensure data security amongst card payment processes, and to take clear steps to ensure all data is held, processed and transmitted securely. This achievement involved external audit of the way all management, storage and processing of payment card & customer data is carried out, and is the standard required of the world’s largest merchants and processors. This audit is an endorsement of Appletree’s security standards and allows it to process large volumes of transactions for any merchant. We don’t just want to keep our certification to ourselves: We are a Level One PCI DSS service provider for you, so you don’t have to worry. With our custom packaged service, your customer data and payments can be handled at the highest level of security with no risk of penalties to yourself.

If you need assistance or have any questions, please consult our FAQs page. Alternatively, feel free to contact us without any hesitation.